Digital identity systems and P2P payments are some of the top potential applications for the adoption of solutions based on blockchains, the underlying technology of Bitcoin

Challenge:

The cryptocurrency Bitcoin has been highly controversial since its beginnings, yet we have only seen the tip of the iceberg in terms of the potential of blockchain technologies. Of great interest to the financial sector, numerous entities are evaluating how these technologies might add value to their operations and how to capitalize on the opportunities they afford. In this context, Opinno has executed a detailed, technological adoption plan for an important bank.

Strategy:

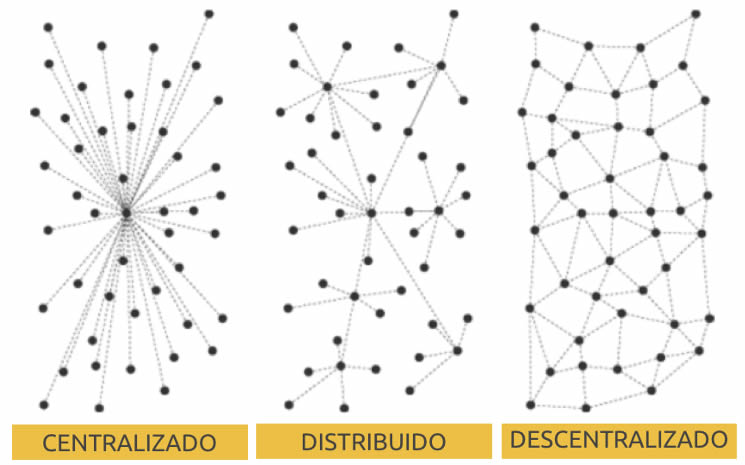

The foreseeable large scale, global emergence of blockchain technologies – or distributed ledger technologies – in more and more fields has made it a fundamental factor for corporate digital transformations and the future of many sectors. This theme has been repeated throughout this project, from start to finish.

Thanks to our connection with the blockchain ecosystem, fostered through ad hoc studies, we focused this study on the design, development and validation of blockchain solutions. "We zoomed in from the general to the specific, from the ecosystem to the possible high-impact business uses according to our client´s needs and the maturity of the market they serve," as our expert in blockchains and project leader Carlos Vivas explains. "This is a search for strategic solutions that not only implement specific solutions but also anticipate the next trends in order to facilitate adapting to changes and the actual transformation of the financial sector", he adds.

Solution:

So, how does general knowledge about blockchains translate into implementation proposals for a company? With a solid understanding of the development of the technology and its environment, we look more deeply into the solutions that will be most widely used by our client, as well as those that are closest to the market – meaning those which are mature enough to generate value propositions in the short term. This is transformed into a roadmap and an action plan that includes complete case studies of which the cornerstone is business benefit. "We don´t only offer proposals and recommendations, but also development plans that cover the end to end process and take into account factors like economic impact, viability, etc.," as our expert explains.

Digital identity, P2P payments and "know-your-customer" (KYC) solutions are some of the most common applications of this technology for our clients. In some cases, our clients are already developing projects internally which have been enhanced and improved through the proposals have developed together. Our project leader explains it as follows: "We are looking for a co-creation process, where the customer´s business expertise is complemented by our technological expertise, a process executed on a daily basis and in a friendly manner. More than a provider, we are a strategic advisor that connects the different functions of the company, from directors and lawyers down to administration and technology."

This also represents an excellent way of ensuring that the client´s needs are always aligned with the project´s objectives and the measures implemented.

A strong bet on blockchain technologies, especially as these technologies are just starting to take off, reinforces the company´s position within the value chain of financial institutions. It is a way of strengthening services in preparation for the arrival of new actors in the technofinantial, or fintech, sector.

Our work with blockchain technologies falls within the framework of the momentum we are building around new lines of technologically-based solutions that allow companies to successfully tackle artificial intelligence, cybersecurity, wearables, data analysis and Internet of Things (IoT).