The banks of the future are going to change radically. Banks should adapt to the mobility of its clients, to the new ways of doing business, new payment methods and even new ways of valuing money. The survival of banks depends in part on innovation and the search for innovative business models to strengthen their capacities and be able to compete in a constantly changing sector.

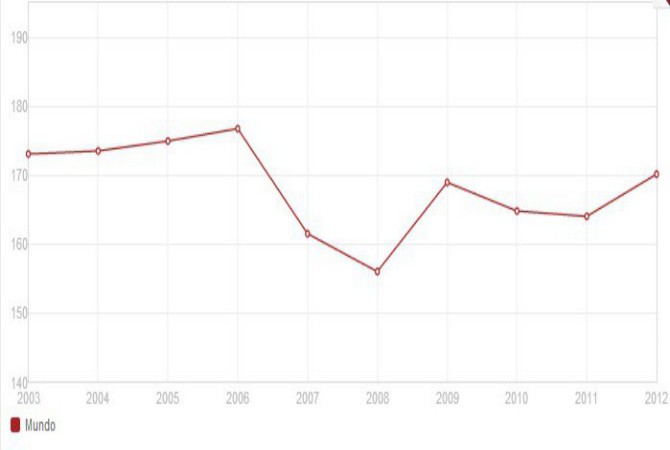

According to Santiago Carbó and Carlos Ocaña, director and general director of Fundación de las Cajas de Ahorros (FUNCAS), “banking is has some large challenges during the next years including a strategic redirection of the business and the answer to the large financial crisis. Thinking about the future of the banking sector means asking as financial entities answer in a more regulated environment, a necessary, prolonged re-launching process of a large part of the economy, a new phase that isn’t risk-free, a progressive ageing of the population and a new international geopolitical order used by globalization and by the disparity between the growth of emerging and developing countries.”

To this you have to add the challenge of startups in traditional banks. With the banking crisis, they went back to the traditional financial strategy in order to be healthy, but incomparable advances in technology makes the opening of frontiers and creation of new business models possible. The businesses need the financial entities and vice versa. But the alliance is a good alternative so that both can be more dimensional.

In this sense, there are lots of debates about the financial system being more sustainable to take on this context and the role that the ecosystem plays in startups. Next Bank Madrid joined the innovation leaders together on the 25th of June in Madrid (Spain) to talk about innovation in financial services. Fermín Bueno, cofounder and partner of Finnovar, declared for Opinno that the objective of Next Bank Madrid was to “create the community of Fintech innovators. Simplify the communication between financial entities and new players in one or two day events, focused above all on the Spanish-speaking market (Spain and Latin America).” He also confirmed “the digital consumer habits is beyond what the banks are offering. These two aspects, technology and the needs that haven’t been covered, provoke a digital wave that will rebuild the industry.”

For Robert Jenkins, member of the Political Financial Committee of the Bank of England, the start of this financial restructuring process passes through the financial core analysis. Jenkins, according to El Blog Salmón, confirms that the banks start to notice that: the reputation of a bank could be critical; the executives are not irreplaceable; the large companies are difficult to manage, the bonus linked to the risks taken shouldn’t be paid until they are taken on; and you shouldn’t trust blindly in auto regulation.

Banks have to be agile and quick on taking the risk with the least amount of failure possible. This way they will be more effective when it comes to losses. But as soon as they start to protest that the banks, businesses and startups should be allies. For example, Opinno Strategy is able to better understand what the market demands and succeed in defining and thinking up products, create prototypes and launch them into the market quickly, efficiently and at a low cost to capture feedback from the market and reinvent the product in tune to the client’s and consumer’s needs; Opinno Training encourages a entrepreneurial and innovative mentality both inside and outside of the company, the collaborative work, the implementation of agile methodologies and information technology in the search for a company transformation.

With the new alliances within the financial sector, the banks will be able to establish an emotional connection with its clients. Transparency and trust are the fundamental pillars used in order to establish the collaboration. “The Spanish financial sector has been a pioneer in incorporating the TIC to its productive model, allowing financial entities to be more competitive and, at the same time, increasing the satisfaction of its clients”, confirmed Telefónica. And the fact that the cities are becoming more and more like smart cities, and the Information and Communication Technologies (TIC) are being used in more sectors (electronic business, education, online banking, e-health…) This is what promotes them into also being an evaluation tool within the financial system.